[ad_1] Retail investors are looking for exits when stock prices fluctuate sharply, but Julian Emanuel from Evercore ISI wants to make money. He calls the

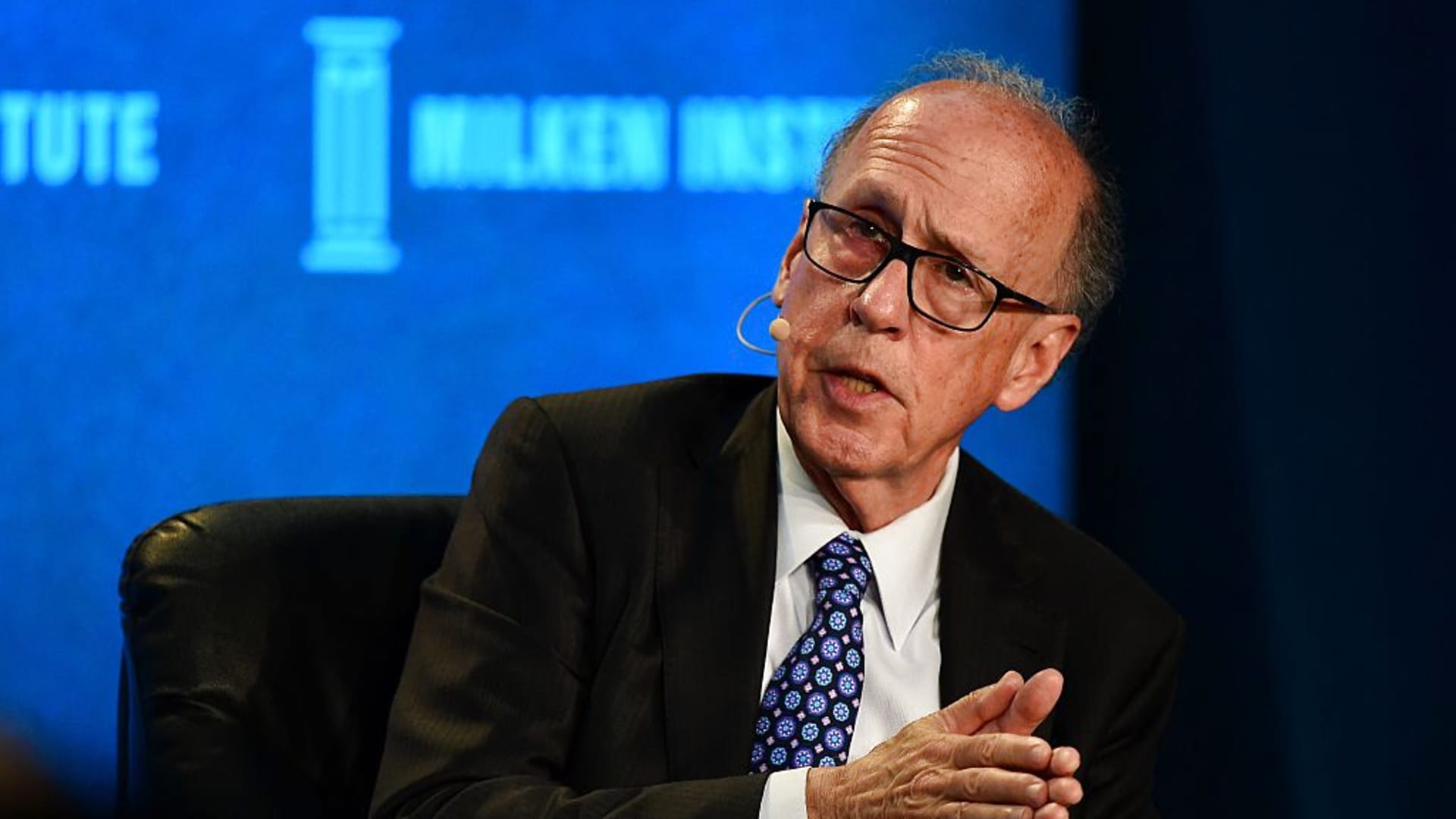

[ad_1] Stephen Roach (ex-chairman of Morgan Stanley Asia) says that Stagflation may be making a comeback. He warned that the U.S. was on a dangerous

[ad_1] Sharon Bell, a senior strategist at Goldman Sachs, has shared her favorite sectors after this week's market madness. [ad_2]

[ad_1] To defuse a year of explosive price inflation, Federal Reserve will raise interest rates. However, global forces may be able to neutralize these effects

[ad_1] It is possible that the market slump will end. Julian Emanuel from Evercore ISI says stocks will start to grind higher because of peaking

[ad_1] According to the Institute for the Analysis of Global Security, the U.S. has been “extremely trigger happy” with its stinging economic actions. Central banks

[ad_1] GoldAccording to Fat Prophets, a fund manager company, this could reach new heights of $2100 an ounce. U.S. dollarDavid Lennox of CNBC stated that

[ad_1] Jeremy Siegel is a long-term market bull and expects a major pullback, but it’s not tied to Covid-19 surge dangers. He urged for a

[ad_1] Pullback Watch: A Bitcoin bull. Mark Yusko, a manager of a hedge fund believes that investors will reap the benefits from the sharp rise

[ad_1] The bank at Westminster, Colorado counts U.S. dollar. Rick Wilking | Reuters Jens Nordvig, a top currency strategist said that he had sold his