We asked 3 major investors what happens next in the market — None of them see big returns

[ad_1]

Where is Alpha Now: Mary Callahan Erdoes, J.P. Morgan Asset & Wealth Management CEO Ashbel Williams, Florida State Board of Administration Executive Director and CIO Jason Klein, Memorial Sloan Kettering Cancer Center SVP & CIO Moderator: Becky Quick, CNBC “Squawk Box” Co-Anchor

CNBC

The strong stock performance of the past year is unlikely to last, according to some of the biggest U.S. institutional investors.

The response by central banks around the world to the coronavirus pandemic has boosted equity returns, Mary Erdoes, JPMorgan Chase head of asset and wealth management, said Wednesday at CNBC’s Delivering Alpha conference.

Erdoes stated that markets have risen 30 to 50% since Delivering Alpha last year, which is clearly unusual. It’s a good time, and we are enjoying it.

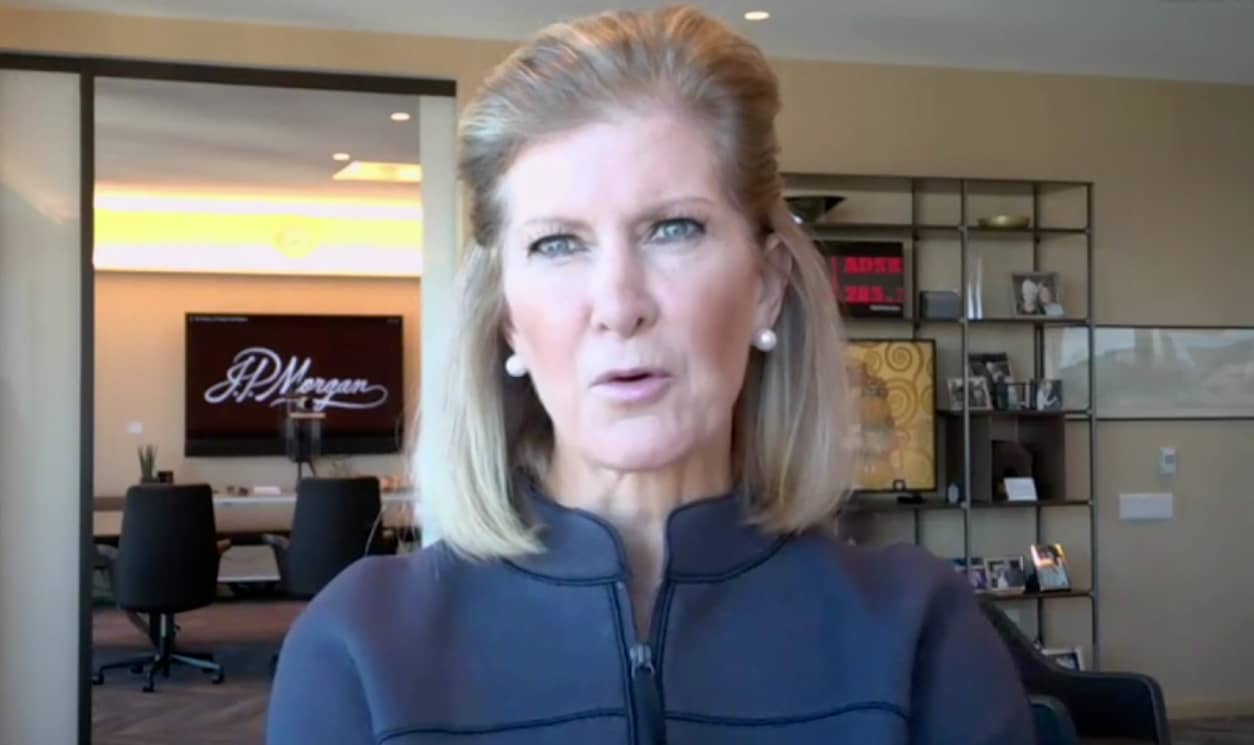

Mary Callahan Erdoes, J.P. Morgan Asset & Wealth Management CEO speaks about Where is Alpha Now at the 2021 Delivering Alpha Conference.

CNBC

Stock returns are likely to be “much more muted” going forward, while volatility will remain the same, according to Jason Klein, chief investment officer of Memorial Sloan Kettering Cancer Center.

CIO suggested that average annualized returns of 10% should be higher than 5%.

Klein stated that “what had been tailwinds, are now headwinds.” Klein believes stock prices are now “stretched market-wide” and may be at risk as the Federal Reserve cuts back on the unprecedented support it provided to markets since 2020.

In response to bonds that offer negative real returns, big investors are seeking alternative investments that provide a yield and that aren’t correlated to stocks, according to Ashbel Williams, CIO and executive director of the Florida State Board of Administration. One of America’s largest pension funds, he manages assets worth more than $195 trillion.

According to him, he invests in planes, TV rights and timber as well as music and trains. Bonds now make up a smaller percentage of his holdings, down to 18% or 19% vs. about 25% a decade ago, he said.

China might be another place that investors should pay more attention to, as equities are falling after regulator crackdowns.

Erdoes declared that China was “on sale”. Clients in emerging markets, and China specifically are all underweight.

Williams and Klein stressed the importance of working with active, world-class managers at this time.

Williams stated that if you have entire markets and believe that asset selection does not matter, then that is great. When things get really difficult and situations impact different industries and companies in different manners ….this time, active management becomes a good idea.

The S&P 500 is up 31% over the last 12 months.

Erdoes noted that the “froth” has not stopped. It will take time to see how far that goes.

[ad_2]