Supply constraints will last until at least 2023

[ad_1]

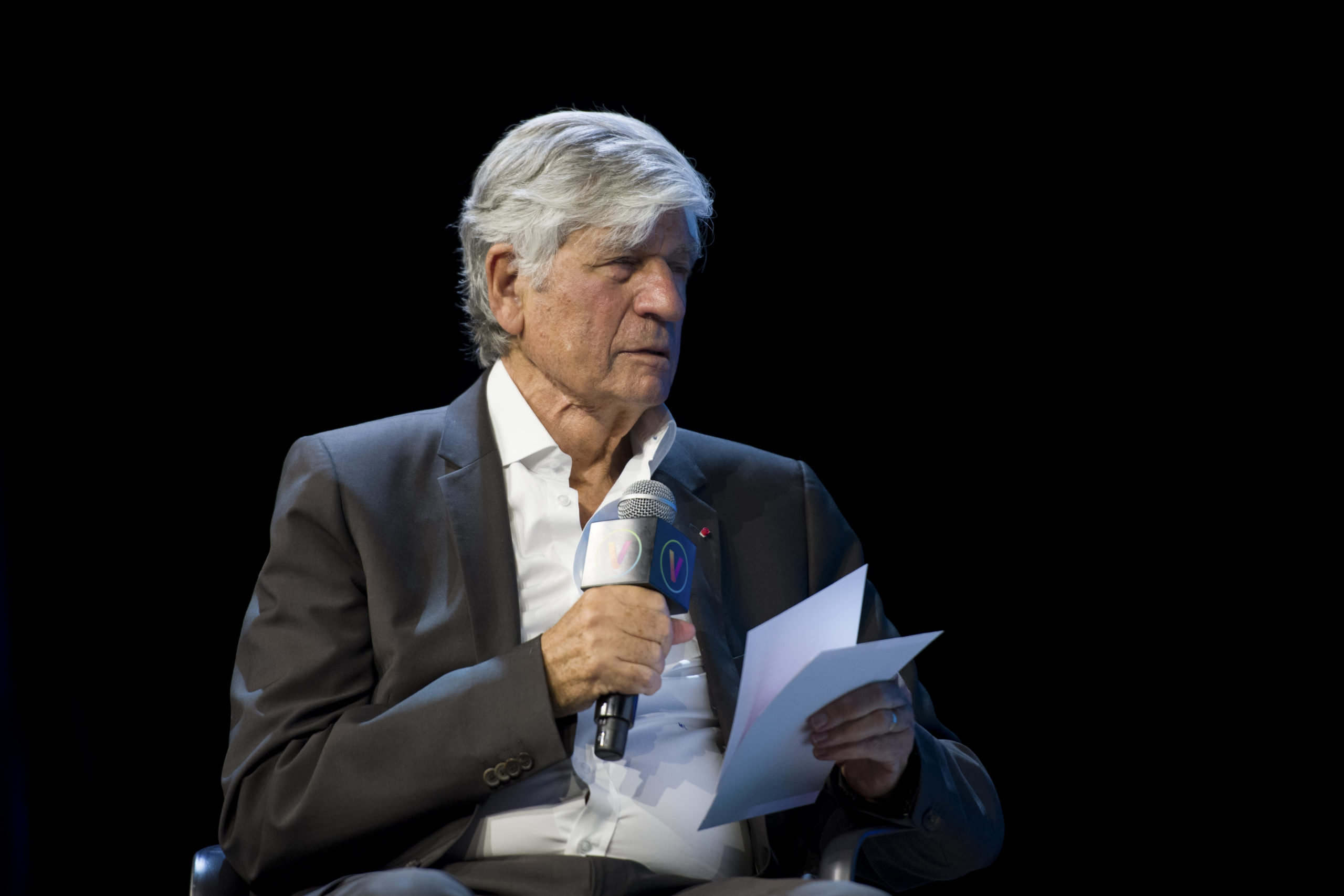

Provide chain pressures hitting the worldwide financial system are prone to final for one more 12 months no less than, in response to Publicis’ Maurice Levy.

Levy, who’s chairman of the board of promoting large Publicis Groupe, advised CNBC’s Karen Tso on the Girls’s Discussion board on Friday that rising inflation was the results of shortage in provide chains.

“It is also the truth that we’re shifting to inexperienced power, we’re shifting to a inexperienced world and we now have difficulties in getting this new power to the extent of the previous world,” he added.

“That is producing a rise in value and weighing on the buying energy of shoppers.”

Economies all around the world are going through shortages of goods and labor, whereas European pure fuel costs surged to record highs in latest months on account of rising demand, excessive climate and low inventories.

Levy stated he believed present inflation and provide points have been reflective of a transition interval, predicting a return to normality “within the area of 2023 [or] 2024.”

“I do not consider it might be the correct factor to do [to raise interest rates right now],” he advised CNBC, acknowledging that many market watchers have been questioning how inflation might be managed.

Surging inflation is being seen all around the world.

The U.S. Client Costs Index increased 6.2% year-on-year in October, marking the largest rise in additional than 30 years.

Throughout the Atlantic, euro zone inflation noticed a year-on-year improve of 4.1% in October — greater than double the European Central Financial institution’s goal. And within the U.Ok., the CPI added 4.2% within the 12 months to October, up from 3.1% the earlier month.

Wharton Finance Professor Jeremy Siegel told CNBC last week that the market was “another dangerous inflation report” away from a correction.

In the meantime, Mohamed El-Erian, chief financial advisor at Allianz, told CNBC’s Dan Murphy earlier this month that the Federal Reserve was shedding credibility over its stance on inflation.

[ad_2]