We’re trimming our position in this best-in-class chipmaker

[ad_1]

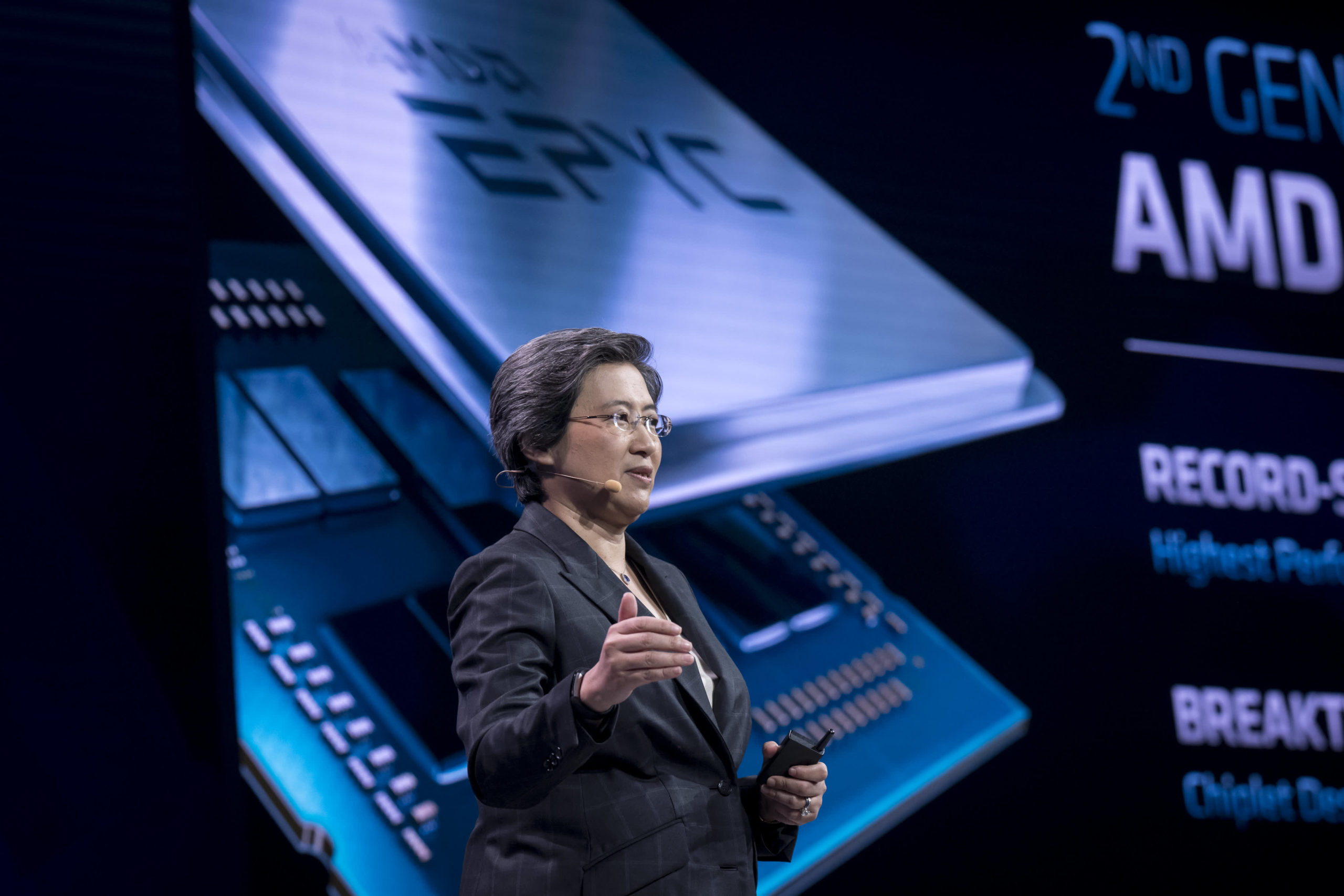

Lisa Su is the president and chief executive of Advanced Micro Devices Inc.

Bloomberg | Bloomberg | Getty Images

This article was first sent to Jim Cramer’s CNBC Investing Club members. Get the latest updates directly to your email subscribe here.)

We will sell 50 shares after you have received this email. Advanced Micro Devices (AMD)Around $160.20 After the trade, 700 AMD shares will be owned by the Charitable Trust. The portfolio’s weight in AMD will be reduced by our trim from 2.93% down to 2.74%.

AMD is being cut this morning purely for portfolio management, and we are not changing our bullish long term view. AMD continues to be a relative leader despite volatile markets.

The reward for patience is well-earned

Advanced Micro Devices has been a strong believer throughout the year. We have stood by it through thick and thin. In February, the stock fell on unfounded concerns about Intel. We bought more shares to increase our holdings. Then we added even more as the tech stocks declined in popularity. The gains from those purchases have ranged between the 70%-100% mark. Our patience was rewarded. These outsized gains are not to be repaid, so we expect to see a return of around 80% for stock that we bought in February.

We have also been consistent buyers in recent weeks and have invested a substantial amount of capital over the last few weeks when certain stocks have moved lower. The slight trimming of AMD close to its peak will allow us to refill our cash reserves and let us continue searching for bargains in lower-priced stocks like AMD. Mastercard (MA)Which we’d buy now if it weren’t for the restrictions.

Jim has mentioned the stock on TV three times in a row. We are not allowed to buy it today. We cannot trade the Charitable Trust stock, but our restrictions won’t stop us telling the Investing club what we would like to buy and when.

Buy now, pay later disruption overblown?

This morning, we saw another data point from a Wall Street Journal articleThat suggested that credit card companies have been disrupted by the rise of “buy now, pay later” outfits. In the article, it was noted that 27% of U.S. customers had in October applied for credit cards. This is according to the Federal Reserve Bank of New York. This is a new high.

Mastercard made two other announcements last night which should be well received by investors. They increased the dividend 11%. The Board also approved a new share-repurchase program that could reach $8 billion. It will take effect after completion of current authorization, which has $4.4 million remaining. The buyback news is a signal that management realizes the stock’s current price relative to its fundamentals, and their strong outlook for 2022-2024 at the recent Investor Day.

Although the omicron variation may have caused some uncertainty regarding the recovery of cross-border expenditure in the immediate future, we don’t see this as a problem long-term and the recent sale-off is therefore a good buying opportunity.

My Charitable Trust now has an official home at the CNBC Investing Club. You can view every portfolio move and receive my market insights before everyone else. Action Alerts Plus has ceased to be affiliated with my writings and the Charitable Trust.

Subscribers to CNBC Investing Club will get a trade alert prior to Jim making a trade. Jim typically waits for a trade signal to be sent before buying or selling stock from his portfolio of charitable trust stocks. Jim must wait 5 minutes before sending a trade alert to the market, if it is pre-market. Jim executes trades if issued within 45 minutes of market opening. Jim may not execute a trade if he has spoken about the stock on CNBC TV for less than 45 minutes. See here for the investing disclaimer.

(Jim Cramer’s Charitable Trust is AMD, MA.

[ad_2]