Companies hit record $14.5 billion in 2021

[ad_1]

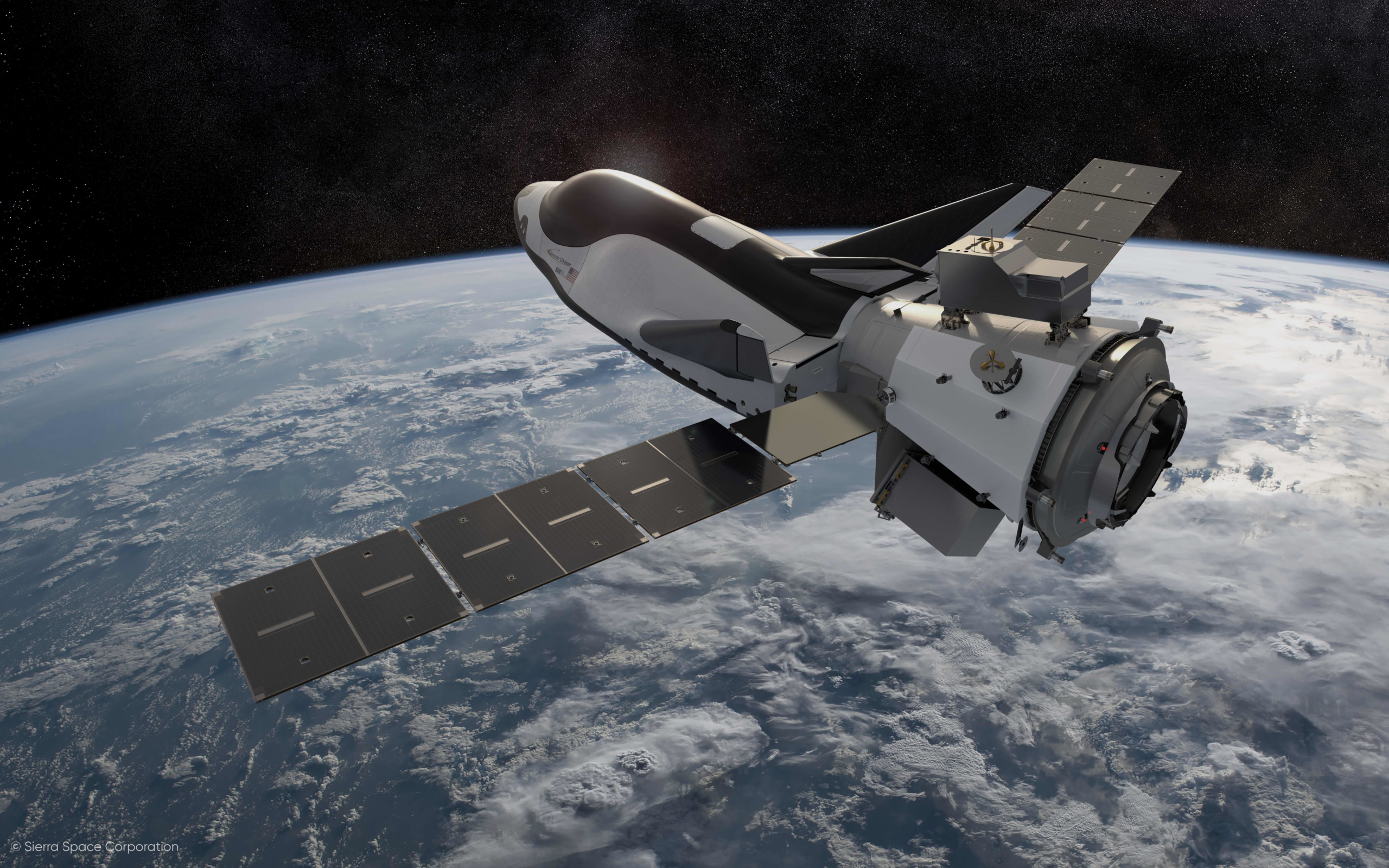

An illustration of a Dream Chaser orbital spaceplane.

Sierra Space

According to, the record for private investment in space firms was set last year. a report Tuesday by New York-based firm Space Capital.

Private investment of $14.5 billion was received by space infrastructure companies in 2021. This is a record-breaking annual total that was more than half a percent higher than 2020. This includes the record-breaking fourth quarter that brought in $4.3Billion thanks to mega-rounds of $250M or more. Sierra Space, Elon Musk’sSpaceX and Planet Labs.

Space Capital reports quarterly on investment in the industry and divides it into three technology groups: distribution, application, and infrastructure. The infrastructure category includes companies that make rockets or satellites.

Space Capital is currently tracking 1,694 companies, which collectively have invested $252.9 billion globally in equity capital since 2012 for all three types of space.

Chad Anderson, Space Capital managing partner and author of the report stated that “As you look forward, there are tremendous opportunities for mass adoption. We also look for radical new approaches to build space-based assets.”

This report highlighted the record level of venture capital investment across these three sectors. The report stated that $17.1 billion was received by space-related firms in venture capital in 2017. This represented 3% of global venture capital investments in the year 20221.

Warning about the evolving market environment

Spire Global, New York Stock Exchange August 17, 2021

Source: NYSE

Space Capital also spoke out about the market changes for the flurry of newly-public space companies, as rising interest rates are hitting technology and growth stocks hard — especially companies where profitability is years away, as is the case with several space ventures.

Anderson stated that “the public markets started the year in a selloff” and venture companies may have difficulty raising record-breaking funds if this trend continues.

Anderson warned that not all SPACs can be created equally, and stated that much of the momentum seen in 2021 was at the expense of thorough diligence. This increases investor risk.

Investors need to understand that investing in the space industry requires specialist knowledge. Anderson explained that we believe this will increase in 2022, as overvalued businesses come down to Earth and high quality companies rise higher,” Anderson added.

[ad_2]