GlobalWafers bid for Siltronic fails amid tech sovereignty concerns

[ad_1]

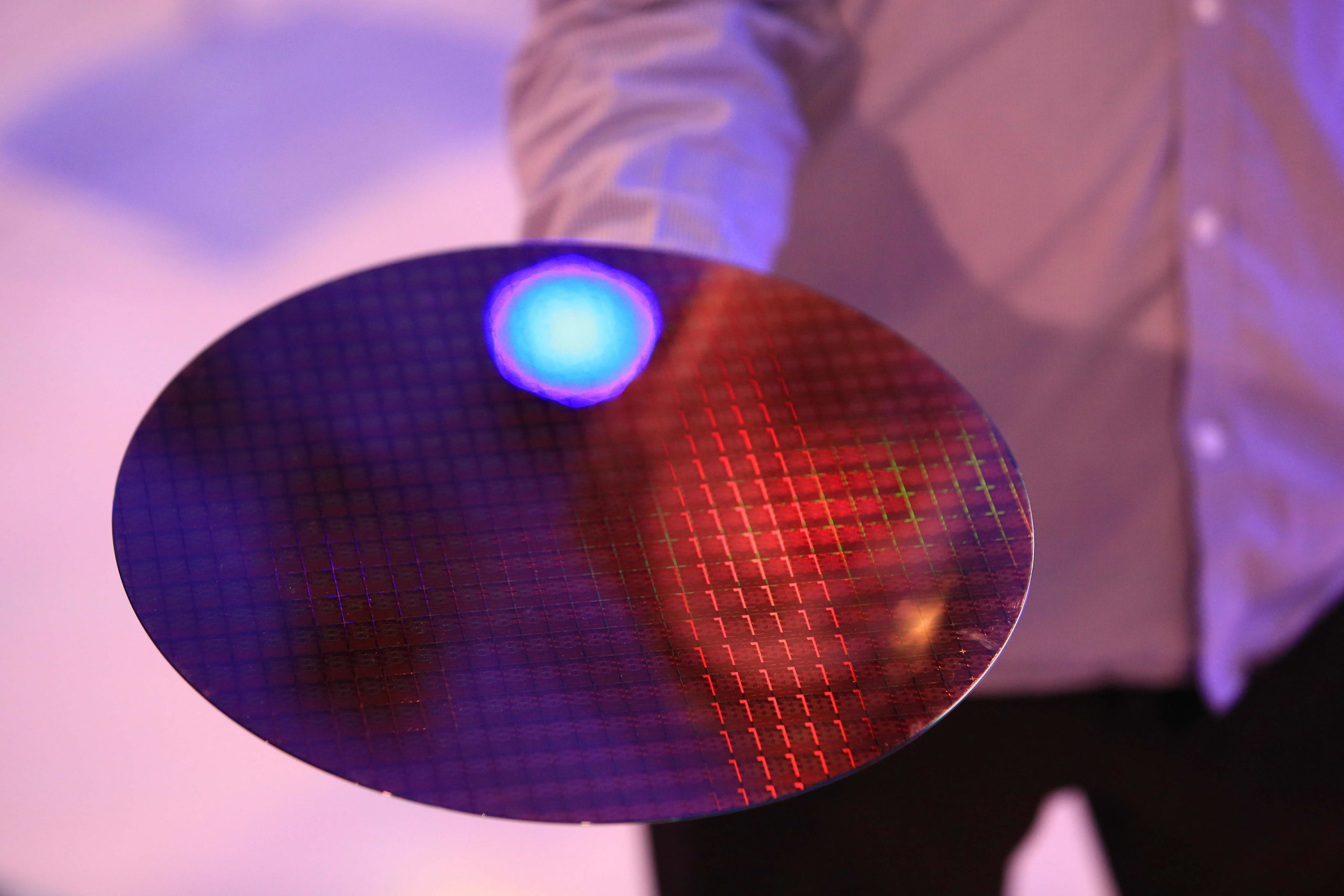

A semiconductor wafer at an Intel event before the IFA International Consumer Elektrons Show.

Krisztian Bocsi | Bloomberg | Getty Images

GlobalWafers is a Taiwanese company that produces silicon wafers to be used in computer chips. It will not buy its Munich-based rival. SiltronicThe deal was rejected by German policymakers.

It was Monday evening that the agreement collapsed. The nations are now looking to improve their technology sovereignty so they can rely less on other countries when it comes to critical technologies, such as semiconductors. Europe currently relies on America and Asia for critical technologies like semiconductors. Samsung, TSMC Intel.

GlobalWafers will no longer be offering to take over the company and any agreements that were created as a result will cease and will be void. GlobalWafers said Tuesday.

Germany’s Economic Ministry failed to approve the deal worth 4.35 Billion Euro ($4.9 Billion) by Jan. 31, meaning that the planned acquisition is not possible.

“It was not possible to complete all the necessary review steps as part of the investment review — this applies in particular to the review of the antitrust approval by the Chinese authorities, which was only granted last week,” a spokesperson for Germany’s Economic Ministry said, according to Reuters.

On Jan. 21 Chinese regulators approved the takeover. It would have made China’s second largest maker of wafers measuring 300 millimeters, behind Japan’s Shin-Etsu.

GlobalWafers now need to pay Siltronic a 50 Million Euro termination fee

Wafers make up a major building block of chips, which are used in everything from iPhones to parking sensors.

Germany is where it all began. InfineonFollowing a global chip shortage that harmed the well-known automotive industry, chipmakers have been more cautious about their supply chain.

GlobalWafers would have to undergo an investment review, according to the ministry.

GlobalWafers’ CEO Doris Hsu stated that the result was “very disappointing.” She added that GlobalWafers will now “analyse the German government’s inaction and assess its effect on our future investment strategy.”

The company stated that Europe remains an important market and that it is committed to its customers and employees.

Siltronic didn’t respond to our request for comment.

Siltronic shares were trading higher than 2% Tuesday morning on the Frankfurt Stock Exchange.

Other chip deals are being investigated by regulators and governments. Most notable is Nvidia’sSoftBank offers $40 billion for U.K. Chip Designer Arm.

Critics are concerned that the merger with Nvidia — which designs its own chips — could restrict access to Arm’s “neutral” semiconductor designs and may lead to higher prices, less choice and reduced innovation in the industry. Nvidia claims that Arm will be able to benefit from more investment and will see greater innovation thanks to the merger.

[ad_2]