SoftBank to list chip firm in New York after Nvidia deal fails

[ad_1]

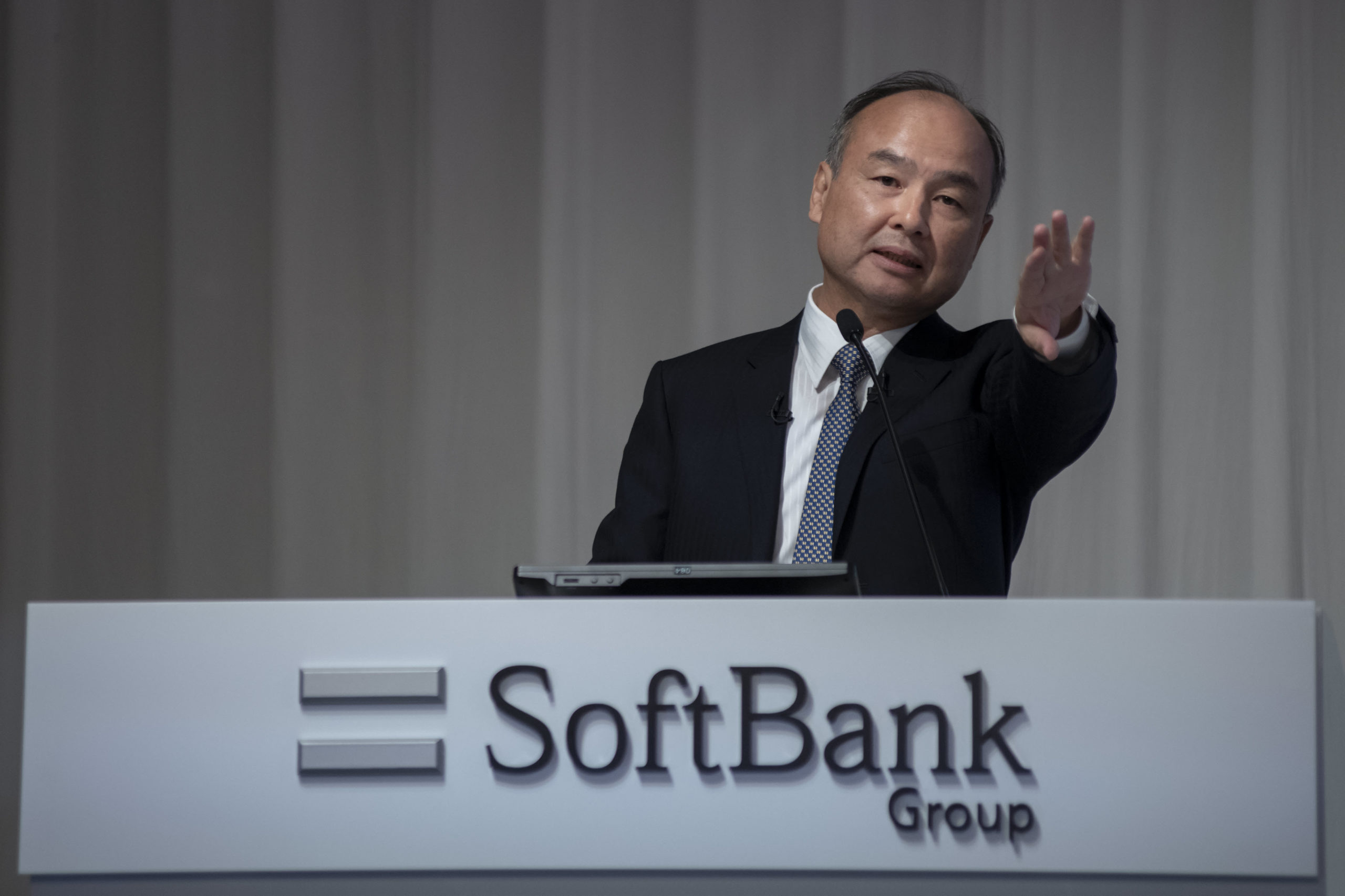

SoftBank Group chairman, CEO and founder Masayoshi son announces the earnings results of his company on May 9, 2019, Tokyo.

Alessandro Di Ciommo | NurPhoto | Getty Images

LONDON — British chip designer Arm, often called the crown jewel of the U.K. tech industry, is set to shun its home market and list in New York, dealing a major blow to the British government and the London Stock Exchange in the process.

The tech-focused listing will most likely include the company. NasdaqMasayoshi son, Japan’s CEO, stated that the stock market was in its fiscal year that ended March 31st, 2023. SoftBankArm is owned by.

Son told reporters Tuesday that “The U.S….that’s the market we are considering when it comes down to listing Arm” and that he was most likely referring to Nasdaq. The U.S. market is what we are looking for to list Arm, regardless of where it may be.

Arm was created in 1990 from Acorn Computers’ early computing business. Its chip architectures that are more energy efficient than conventional chips can be found in about 95% worldwide smartphones, and 95% in the Chinese-made chips. Arm employs around 6,500 people globally, and 3000 in the U.K.

The stock was listed in both New York and London until SoftBank purchased it for $28 million. $32 billion. Although the U.K. government celebrated the sale of Arm to SoftBank at that time as a huge success, it is now reluctant to see the semiconductor company listed or transferred to an overseas entity. There is still the ongoing global chip shortageIt has led nations across the globe to rethink where they make and design chips.

SoftBank bought Arm and tried to make it available to U.S. chip company giants. NvidiaHowever, the companies said Tuesday that they would be launching a new product. deal collapsedDue to “significant regulatory difficulties.” “Significant regulatory challenges” were encountered by the U.S., U.K. China, and Europe antitrust regulators.

Son stated Tuesday that “We are thrilled to move to plan B.” He said plan B would be a big IPO, which will make the semiconductor industry one of its most dynamic.

London IPO: There is no upside

U.K. is keen for its top tech companies, to list in the UK. This will help the country’s economy as well as the stock exchange. Many companies have gone public in New York to benefit from higher valuations on Nasdaq.

Here are some of the top tech companies that trade on Nasdaq Apple, Microsoft, AmazonAnd AlphabetEach of them have a total market capitalization exceeding $1 trillion. On the London Stock Exchange, however, only 50 billion is the value of the top tech firms.

CNBC spoke with Hussein Kanji of Hoxton Ventures, London’s venture capitalist, about why it was “irrational for SoftBank” to give preference to a U.K. Listing over a U.S. one.

He stated that listing in the U.K. has no upside and there is enough downside, noting a lack of research, low valuations, and the media. To convince people to change, you need to offer upside and downside.

CNBC was contacted by another venture capitalist. The sensitive nature of this discussion prompted him to remain anonymous.

According to them, it is difficult for people to understand why this London-based exchange exists. According to the VC, if Arm were listed in London it would signal “a significant sign of confidence” in the tech ecosystem’s public markets and geopolitical strength.

Dual-listing?

Last year saw a few household U.K start-ups list on the London Stock Exchange. However, not all IPOs went as planned.

Deliveroo is an app that delivers food to your door. Darktrace, a cybersecurity company, also experienced rocky times. TransferWise, a fintech firm in the United States is much more valued than its U.S. counterparts.

SoftBank or Arm might opt for dual-listing once more.

SoftBank’s spokesperson stated to CNBC that Arm has yet not received a decision regarding its listing destination. London Stock Exchange refused to comment.

U.K. lawmaker Darren Jones posted on Twitter Tuesday, “If Arm isn’t competitively listed on London stock exchange then it’s not possible for the Chancellor to claim London as the best place raise significant capital technology companies.”

Analysts are speculating on whether SoftBank can list Arm for the same price as it received from Nvidia.

SoftBank bets its billions upon 400 companies, which includes Arm. While some bets have been successful, others have fallen.

Son declared, “We are caught in a snowstorm.” It is difficult to compete in the market. The long-term interest rate is rising. Around the world, the monetary policy is shifting. The stock market is a problem for high growth companies. The AI revolution continues to grow. Big time. We are so excited.”

He said, “The weather is not good.” We’re holding on tight. We’re still starting to plant our seeds. We are going to have a great spring.

[ad_2]