Ukraine tensions, inflation push chip stocks even lower

[ad_1]

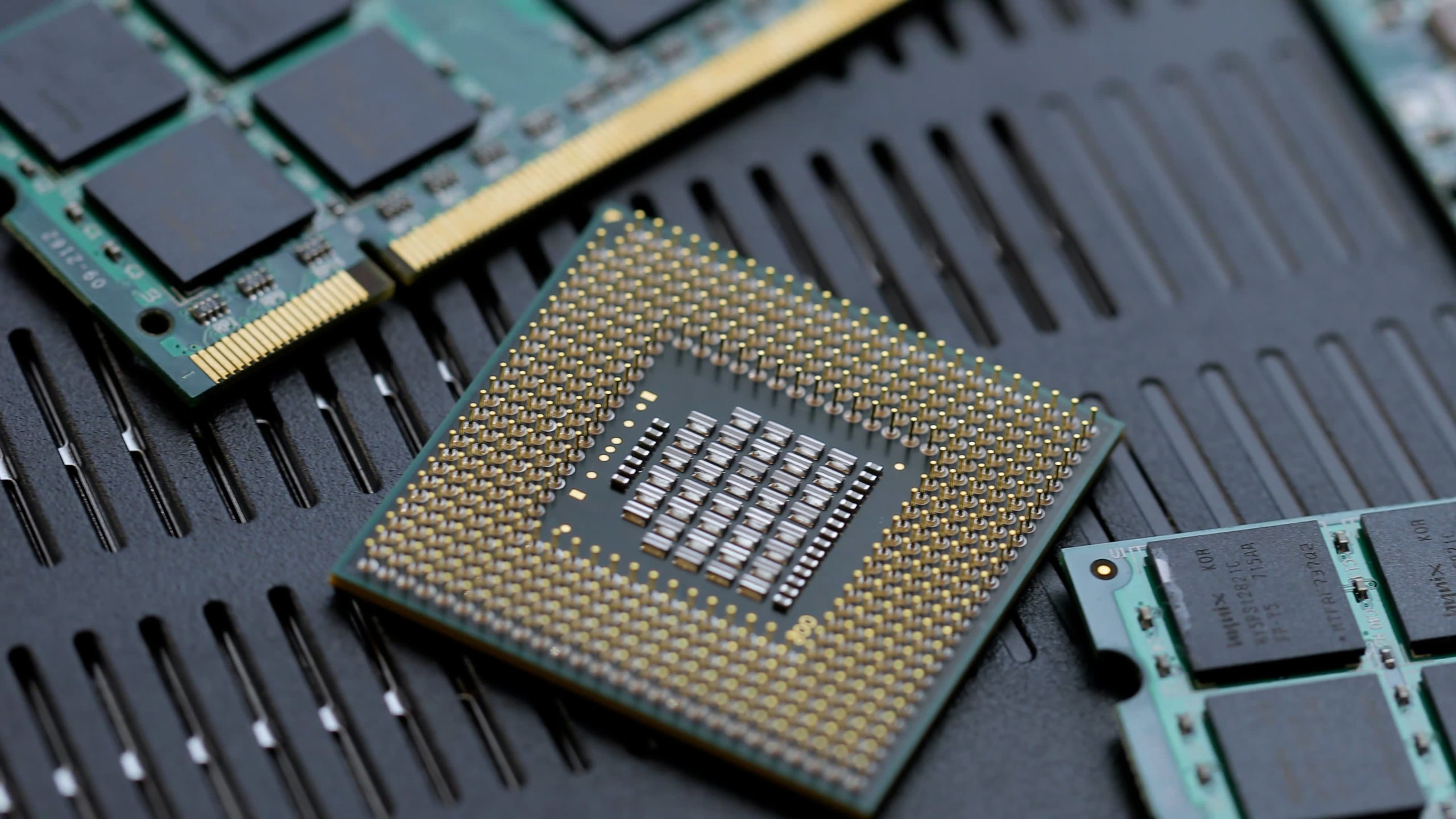

Taiwan Semiconductor Manufacturing Company makes a chip

TSMC

Semiconductor stock prices fell on Friday, as investors digested hotter-than-expected inflationAnd increased tensions between Ukraine and Russia.

Increased demand in the aftermath of the pandemic boosted chipmakers and has generally been reported strong earningsAnd outlooksIn the last month.

Investors are now looking for safer stocks to invest in an inflationary climate. Reuters reportedOn Friday, chipmakers may face shortages of key components such as semiconductor-grade neon in the event that Ukraine invades.

One of the largest losers was AMDThe share price for, fell 10% to $113.14/share on Friday. This is around 30% lower than its peak in November last year. The chipmaker had earlier this week announced that it has received approval from the government for its acquisition of XilinxAlso, the slipped about 10% Friday.

MarvellThe stock of, a company with a rapid growth rate that produces chips for storage and networking, dropped more than 7 percent on Friday.

NvidiaAlso, Friday’s drop was over 7% and it is now down 30% from last November’s peak. Under regulatory scrutiny, Arm’s major acquisition of chip design company Arm was canceled this week. On Wednesday, it reported fourth quarter earnings.

QualcommThe decline was more than 5%. It is down to over 11% as of 2022. IntelThe decline was more than 2% BroadcomAlso, the drop was 3%

This was not a one-off event, but chip stocks were affected by broader slumps. Many smaller companies also lost shares on Friday. VanEck Vectors Semiconductor ETF is traded under the ticker SMHOver 5% of the stock market closed on Friday

It happened amid a rough day for the marketsThe technology-rich Nasdaq Composite dropped 2.78%, while the Dow Jones Industrial Average plummeted over 500 points.

After an increase in oil prices that was apparently linked to increasing concerns, stock markets fell sharply. about Russia invading Ukraine.

On Friday, Treasury yields increased suggesting investors are closely watching the Fed’s possibility of raising interest rates sooner than expected. Analysts at Goldman Sachs stated this week that they expect seven rate increases in response to rising inflation. which surged 7.5% in JanuaryCPI data from this week show that it was a minuscule.

[ad_2]