Biden’s 2023 budget makes no mention of student loan forgiveness

[ad_1]

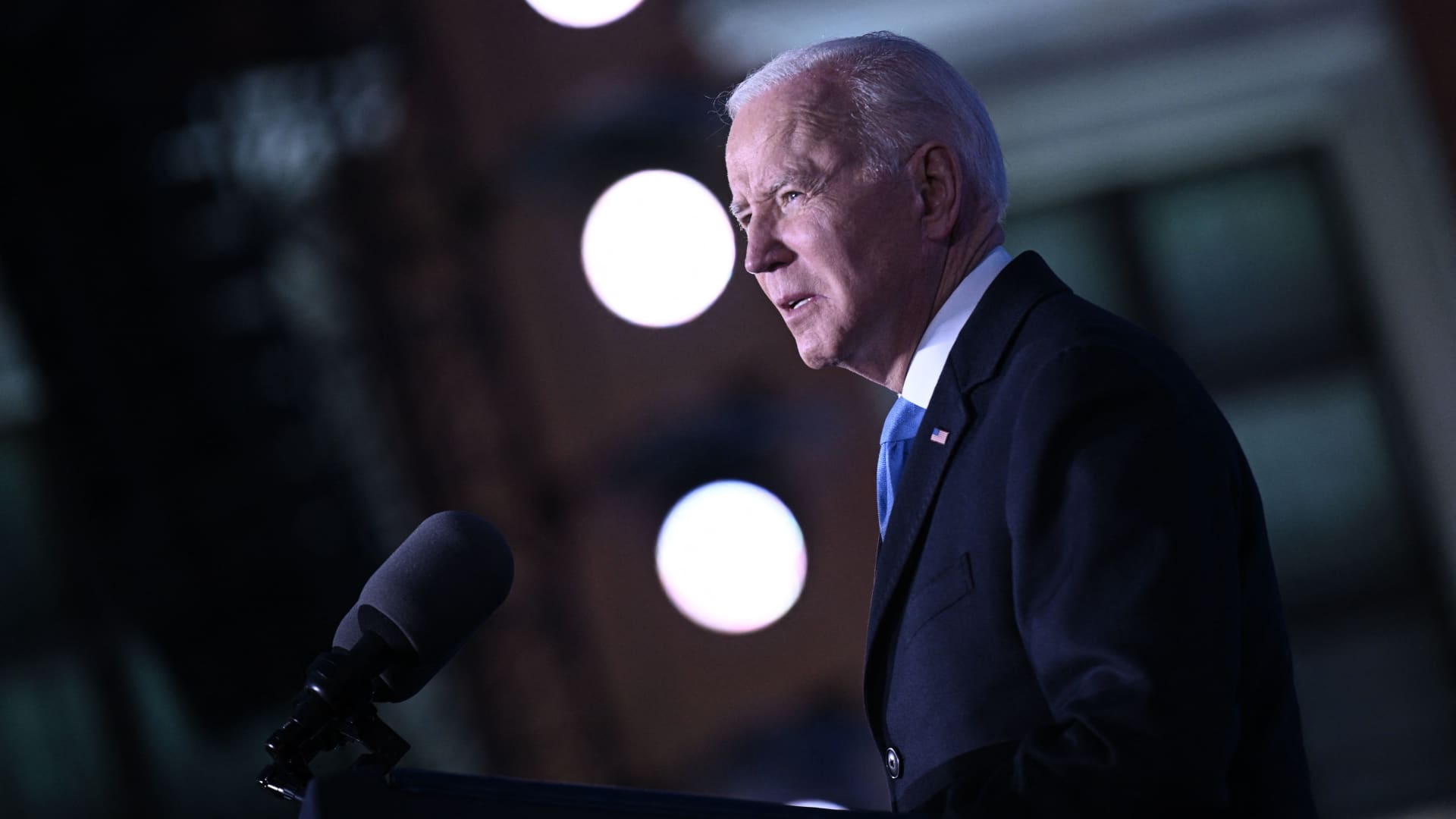

American President Joe Biden speaks at Warsaw’s Royal Castle, Poland (March 26, 2022).

Brendan Smialowski | AFP | Getty Images

There is no mention in the more than 100-page President Joe Biden budget for 2023 of any student loan forgiveness.

The White House only requested more funding — $2.7 billion — to improve customer service for borrowers.

Learn more about Personal Finance

7 things to know about the SEC climate rule

Here’s the average tax refund so far this year

How to avoid a 6-figure tax penalty on foreign bank accounts

However, it is not known when students with student loans may need to speak with servicers. Due to the repeated extension of the pause, most borrowers have not made any payments on their debt for more than 2 years.

Although Biden has not provided any detail on the payment pause, administration officials suggested they were considering postponing the resumption payments past May. They are currently scheduled to resume in May.

Ron Klain (White House Chief of Staff) stated that Biden had indicated earlier this month that he wanted the White House to cancel its debt cancellation decisions before re-entering payments.

Klain, host of the podcast “Pod Save America,” stated that “The President is going to examine what we should be doing on student debt before it expires or he will extend the pause.”

Mark Kantrowitz from the higher education specialist said that, in order to request Congress for implementation of it, it would probably only offer forgiveness.

The administration could have overlooked it, indicating that they were still thinking of cancelling debts without new legislation or executive actions.

He stated that “they don’t have to budget for an additional extension”.

Advocates and Democrats warn that payments should not be restarted before November’s mid-term elections.

Recent research shows that borrowers might face serious hurdles by May. One estimateNearly a third could face high-risk defaults if they do not receive extensions to their loans.

Before the outbreak, student loans owed more to the nation than any credit or car debt. The average student loan balance at graduation was $30,000 and approximately 25% of borrowers (or 10 million) were in default or delinquency.

A recent poll found that nearly 66% of likely voters are in support of Biden canceling some or all of student debt, with more than 70% of Latino and Black voters in favor.

Critics of a student debt jubilee It would not be fair to people who haven’t borrowed for education, or paid off loans. significantly stimulate the economy because college graduates tend to be higher earners more likely to redirect their monthly bill to savings than additional spending.

Servicers as well as borrowers are frustrated by the current lack of guidance. Scott BuchananExecutive Director of the Student Loan Servicing Alliance (a trade organization for federal student loans servicers)

Buchanan stated that servicers were forced to shift the repayment dates arbitrarily, causing confusion and wasting lots resources.

[ad_2]