JPMorgan investors hand Dimon rare rebuke, object to $53 million bonus

[ad_1]

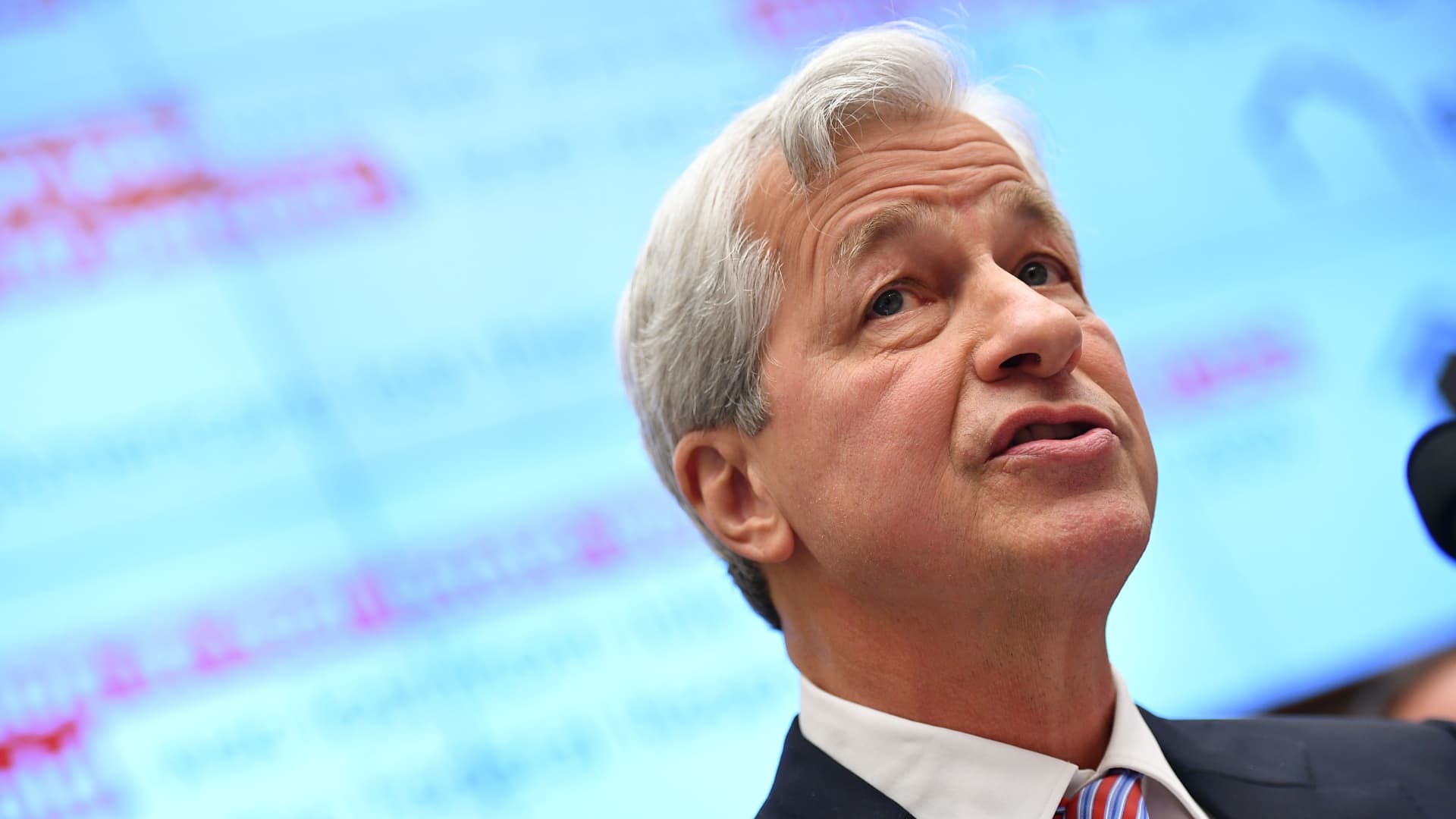

JP Morgan Chase & Co. Chairman & Chief Executive Officer Jamie Dimon testifies before the House Financial Services Committee on accountability for megabanks in the Rayburn House Office Building on Capitol Hill in Washington, DC on April 10, 2019.

Mandel Ngan | AFP | Getty Images

JPMorgan ChaseChief Executive Officer Jamie DimonOn Tuesday, the bank received a rare repudiation after shareholders rejected an enormous retention bonus.

Only 31% of the New York-based bank’s shareholders supported Dimon’s $52.6 Million award as part of his 2021 compensation package.

Bonus in the amount of 1.5million optionsThe 2026 exercise that Dimon is allowed to do in the future was created to ensure the chairman and CEO of JPMorgan are still at the top for five more years. According to Joe Evangelisti, a bank spokesperson, the value of this stock fluctuates depending on how much shares appreciate.

“The special award was extremely rare – the first in more than a decade for Mr. Dimon – and it reflected exemplary leadership and additional incentive for a successful leadership transition,” Evangelisti said.

The results of “say on salary” aren’t binding. However, JPMorgan said that its board values investors’ feedback and wanted Dimon to receive a bonus.

It was the first time JPMorgan had its compensation board downvoted since more than a decade after the measure was introduced. Dimon (66), has been JPMorgan’s chief executive since 2006. He helped to guide the bank through many crises, and built it into America’s largest bank in terms of assets.

Proxy advisory firms included earlier this month Glass, Lewis & CoRecommendation: Shareholders should rejectDimon and his top lieutenant received a pay package. Dimon received $84.4million last year in pay, which includes the retention bonus.

Glass Lewis stated in his report that excessive one-off gifts to CEO and COO, despite tepid relative performance, worsen long-standing worries regarding executive-pay programs.

Dimon, along with his fellow directors, received support from investors in a different way. This is typical for a vote of shareholders at large companies.

[ad_2]