Morgan Stanley says that the massive decline in semiconductor stocks has made it possible to buy the dip. The firm named two major global chipmakers as well. The tech sector has seen a wider sell-off this year and semiconductor stocks took a blow. Morgan Stanley sees an opportunity to purchase the best-valued global semiconductor companies, as well as those of “highest quality” and most dominant. Shawn Kim led the bank’s analysts in a note called “Clash on Chips”, dated May 20. They pointed out that today there are three big producers: Taiwan Semiconductor Manufacturing Company (Samsung ), and Intel. They stated that the cost of implementing the latest process technology for semiconductor chips requires high levels of investment as well as operational excellence. Kim stated that TSMC, Samsung, and other leading companies will continue to be the leaders in advanced semiconductor manufacturing over the next decade. This is to capitalize on the huge and growing foundry market. He said that Intel’s future role was “less certain.” TSMC is the sole company that operates foundries to produce cutting-edge semiconductors. Nvidia, Qualcomm, and Apple are their largest customers. TSMC shares and Samsung share prices are both down 15% over the past year. This is more than the iShares Semiconductor ETF, down 26% in the same time period. Demand for leading-edge semiconductors – the smallest and most powerful chips – has been booming as innovation in areas such as cloud computing, artificial intelligence (AI), smart vehicles, and 5G takes off. According to the bank, high-performance computing (which includes AI and cloud) will soon outstrip smartphone demand. TSMC “TSMC is a leading player in global semiconductors as a pure play foundry – and is now dominating in leading edge semiconductor manufacturing in terms of technology and market share,” Kim said. Morgan Stanley says the company is the most important semiconductor findry worldwide, with “formidable customers” and is an “essential enabler” of multiple technology megatrends. According to the bank, TSMC also has superior fundamentals that suggest a higher rate of earnings growth. Morgan Stanley reports that the company experienced a 10% compound annual sales growth between 2015-2020, in comparison to Samsung’s 7%. The trend will continue through 2023. TSMC is forecast to increase sales at a compounded rate 22%, compared with 15% for Samsung. Samsung Morgan Stanley stated that Samsung’s horizontal and vertical integration give it an “unique advantage” and that there is a $1.4 trillion market potential. Kim projects that Samsung’s operating margins would remain steady at about 20% in 2024 with the company producing “massive amounts” of free cash flow, which will be around $30 billion through 2023. Morgan Stanley’s price target for TSMC is a 50% upside, while Samsung’s target price of 85,000 Korean won ($67.30), represents a 27.8% upside. The analysts have an overweight rating on both stock.

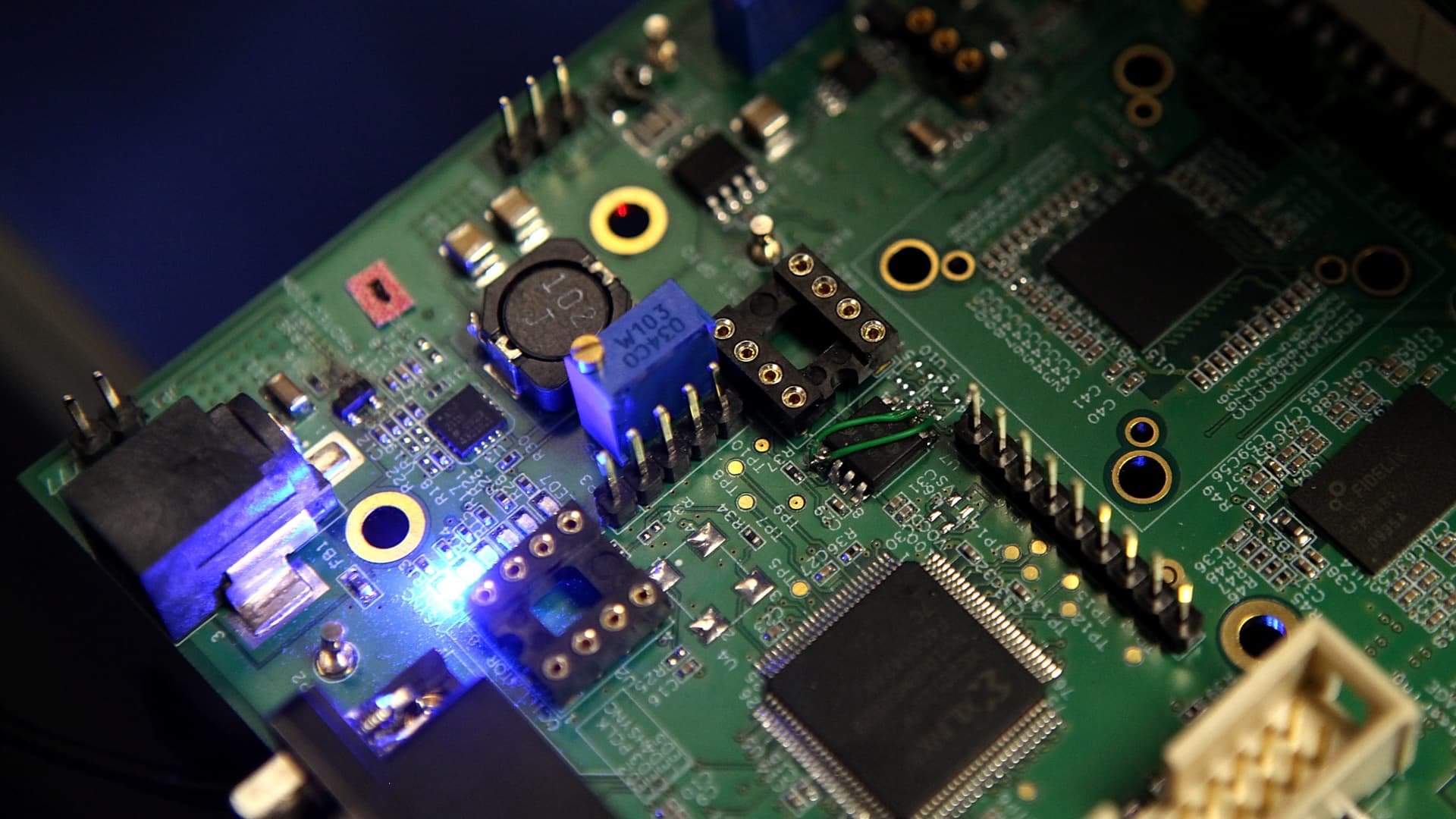

Circuit boards are home to semiconductors.

Justin Sullivan | Getty Images

Morgan Stanley names the global chipmakers that it anticipates will dominate, and says this is because of the huge sell-off in semiconductor stocks.