UST debacle will ‘probably be the end’ of algorithmic stablecoins

[ad_1]

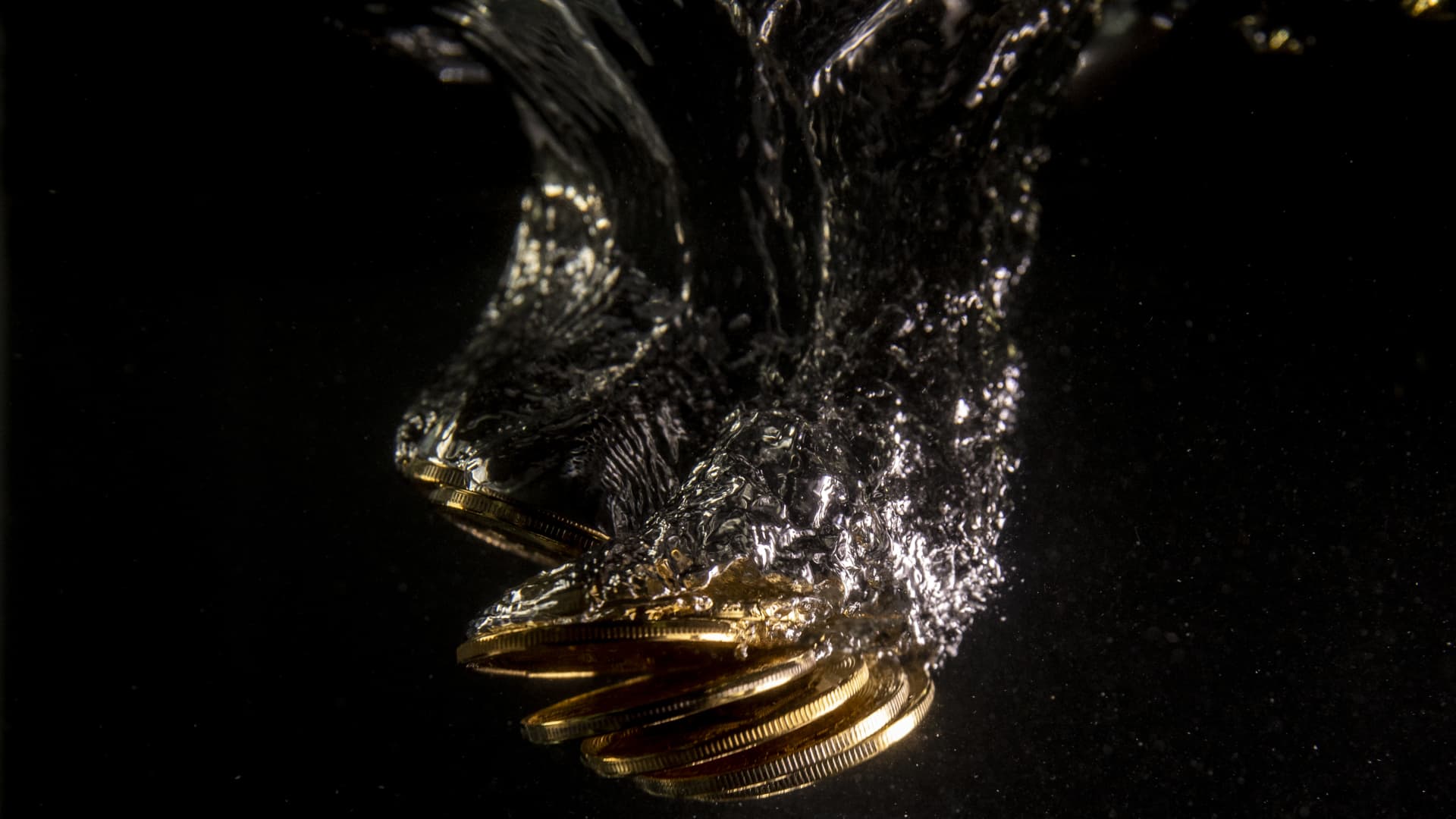

Luna, the sister cryptocurrency of controversial stablecoin TerraUSD, dropped to $0. The collapse of the algorithmic stablecoin TerraUSD has raised query concerning the future survival of comparable crypto property.

Dan Kitwood | Getty Photos Information | Getty Photos

Algorithmic stablecoins like terraUSD, which collapsed and despatched shockwaves by means of the cryptocurrency market, are unlikely to outlive, the co-founder of digital foreign money tether instructed CNBC.

Stablecoins are a kind of cryptocurrency that’s often pegged to a real-world asset. TerraUSD or UST, is an algorithmic stablecoin which was purported to be pegged to the U.S. dollar.

Whereas stablecoins like tether and USD Coin are backed by real-world property similar to fiat currencies and authorities bonds so as to keep their greenback peg, UST was governed by an algorithm.

UST misplaced its greenback peg and that additionally led to a sell-off for its sister token luna, which crashed to $0.

The debacle has led to warnings that algorithmic stablecoins won’t have a future.

“It is unlucky that the cash … was misplaced, nonetheless, it isn’t a shock. It is an algorithmic-backed, stablecoin. So it is only a bunch of sensible individuals making an attempt to determine peg one thing to the greenback,” Reeve Collins, the co-founder of digital token firm BLOCKv, instructed CNBC on the World Financial Discussion board in Davos, Switzerland, final week.

“And lots of people pulled out their cash in the previous couple of months, as a result of they realized that it wasn’t sustainable. In order that crash form of had a cascade impact. And it’ll in all probability be the top of most algo stablecoins.”

Collins can also be the co-founder of tether, which isn’t an algorithmic stablecoin. However tether’s issuer claims it’s backed by money, U.S. Treasurys and company bonds. Within the crypto market turmoil final month, tether also briefly lost its dollar peg before regaining it.

Jeremy Allaire, CEO of Circle, one of many firms behind the issuance of the USDC stablecoin, mentioned he thinks individuals will proceed to work on algorithmic stablecoins.

“I’ve in contrast algorithmic steady cash to the Fountain of Youth or the Holy Grail. Others have referred to it as monetary alchemy. And so there’ll proceed to be monetary alchemists who, who work on the magic potion to to create these items, and to seek out … the Holy Grail of a steady worth, algorithmic digital foreign money. So I absolutely count on continued pursuit of that,” Allaire instructed CNBC final week.

“Now, what occurs with regulation round it’s a completely different query. Are there going to be, , clear traces drawn about what can work together with the market. What can work together with … the monetary system, given the dangers which are embedded,” he added.

Regulation forward

The crytpo trade is anticipating harder regulation on stablecoins, particularly after terraUSD’s collapse. Bertrand Perez, CEO of the Web3 Basis and a former director of the Fb-backed Diem stablecoin venture, expects regulators to demand that such cryptocurrencies are backed by actual property.

“So I count on that when we now have a transparent regulation of stablecoins, the fundamental guidelines of the regulation can be that you’ve got a transparent reserve with a set of property which are robust, that you just’re topic to common audits of these reserves,” Perez instructed CNBC final week.

“So you possibly can have an auditing firm that comes often to just remember to have the right reserves, that you’ve got additionally the right processes and measures so as to face financial institution runs and different, for example, damaging market circumstances, to guarantee that your reserve is basically safe, not solely when all the pieces goes properly.”

[ad_2]