How to invest in the car of the future, according to Bank of America

[ad_1]

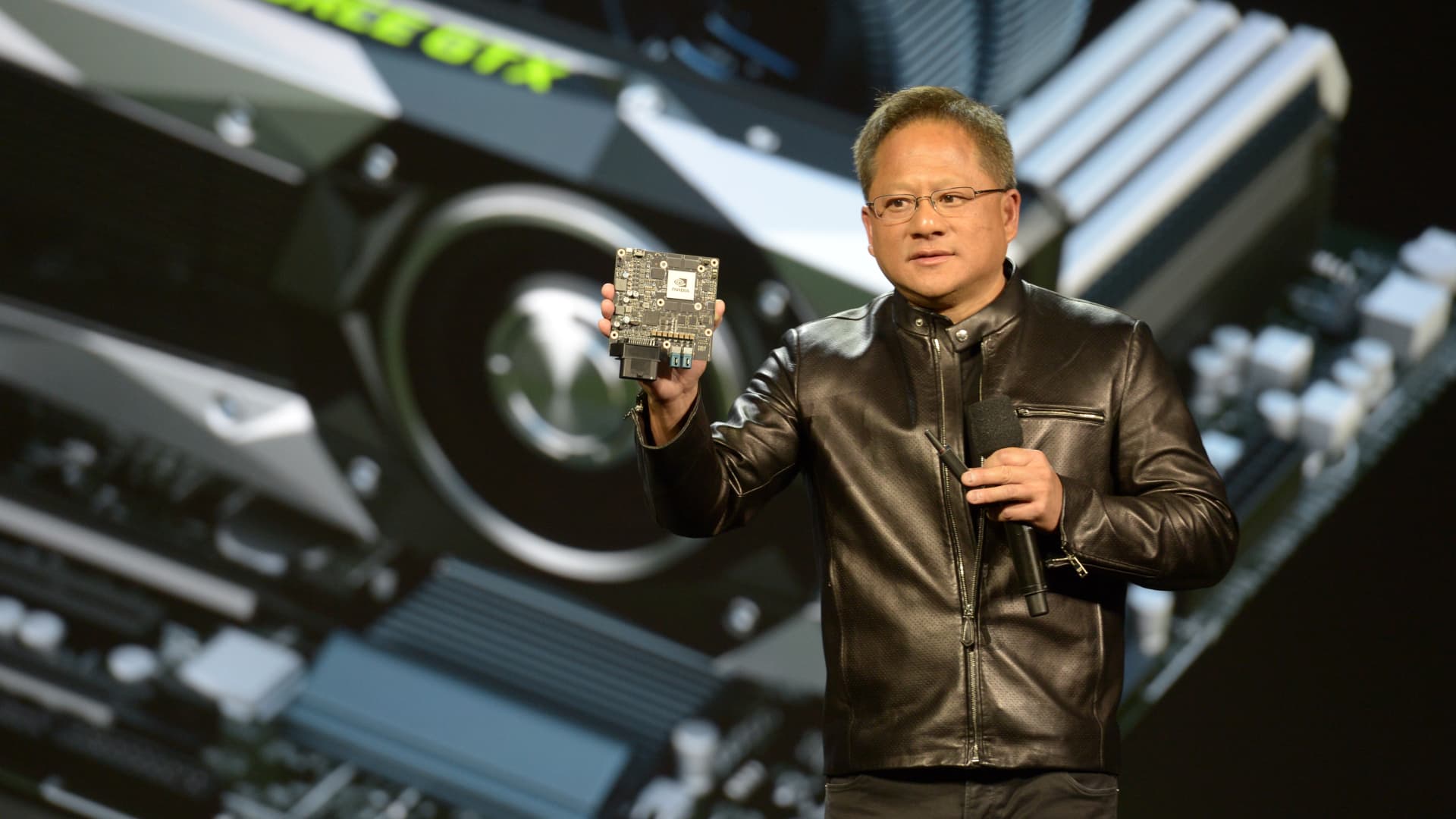

The future is full of driverless cars and hi-tech vehicles. Bank of America suggests that investors who want to capitalise on this emerging trend invest in companies which play an important role in the changing market. According to Bank of America, Wednesday’s annual report highlighted the importance of the automotive industry and identified several suppliers and manufacturers that could benefit.[A]John Murphy, an analyst, wrote that while the global market is maturing and there has been increased competition, it has also become more difficult for suppliers to compete. We find that those who have valuable and proprietary technology are the best suppliers, but they also have substantial global scale and can leverage cost and investment. Also, these suppliers will be able to handle volatility across all regions or automakers. Bank of America identified several emerging trends in the industry. These include an increase in outsourcing of original equipment manufacturing to suppliers, and new entrants as a means to finance high-tech car additions. In recent months, suppliers and manufacturers of automobiles have been under severe pressure due to chip shortages and rising material costs. This has made it harder for them to manage supply chain disruptions caused by the conflict in Ukraine. The market’s mismatch of supply and demand has caused new and used car prices to soar in recent years. E Source, a research company, recently reported that electric vehicle production costs could increase by 22% by 2026 if there is a shortage of raw materials. Here are the top choices of Bank of America for investors who want to invest in the sector. Semiconductor giant Nvidia will benefit from electrification efforts and autonomous vehicles. Its stock has fallen by nearly 36% over the past year but it could rebound 43% depending on Tuesday’s closing prices and Bank of America’s price goal. Nvidia’s strong connections to artificial intelligence continue to make it a leader in growth. Murphy explained that “demand for automotive semiconductors will only rise from here” as the overall industry recovers in the 2020-2022 COVID-induced slump and broader secular trends such increased vehicle electrification/autonomy and connectivity gain momentum. NXP Semiconductors was also listed by Bank of America as one of the companies that will benefit from automobile evolution. However, shares fell about 20% and 4% respectively this year. Aptiv is one of the best-positioned suppliers. Murphy indicated that the company was one of the top-placed suppliers because it has exposure to the market for electric vehicles and autonomous technology. The bank likes the joint venture of Hyundai and self-driving cars. Murphy said that this product exposure will continue to drive significant revenue growth over peers. He also noted that the bank’s growth has been in double-digits more recently than industry average. — CNBC’s Michael Bloom contributed reporting

[ad_2]