Oil Extends Gain After Eighth Weekly Advance on Energy Crisis By Bloomberg

[ad_1]

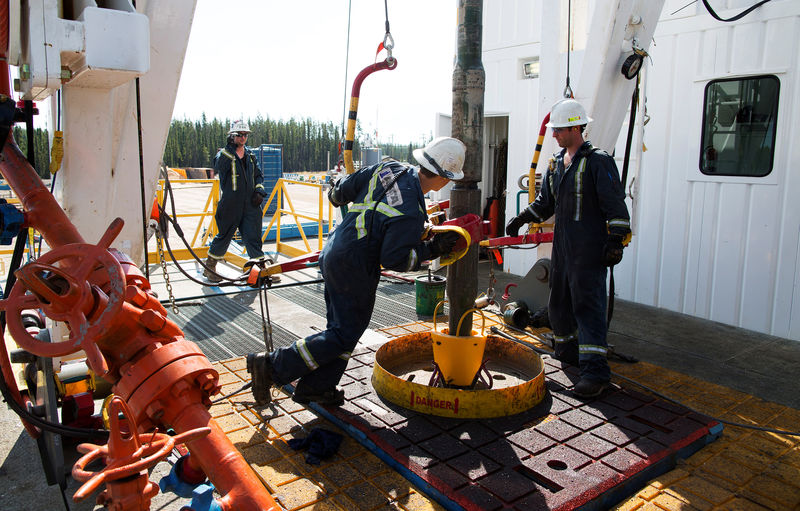

© Reuters. Oil Gains after Eighth Weekly Advance on Energy Crisis

© Reuters. Oil Gains after Eighth Weekly Advance on Energy Crisis(Bloomberg). Oil gained at the opening of Asia trading after a eighth week of gains, with the market facing an energy crisis ahead of winter.

New York futures rose close to $83 per barrel last week after an increase of 3.7%. It was the largest weekly gains in New York since 2015. Additional demand is being generated by oil products for power generation due to a shortage in and from Asia to Europe. That’s coincided with key economies rebounding from the pandemic, leading to a significant tightening of the market.

See also: Don’t Expect OPEC to Keep You Warm This Winter: Julian Lee

The oil price has risen to its highest point since October 2014 partly due to disruptions in supply in the Gulf of Mexico caused by Hurricane Ida. This was also after a period of uncertain demand as a result of the delta virus. As the global energy crisis increases prices, Asian demand is increasing for oil.

Brent saw a prompt timespread of 71 cents in Backwardation. This bullish market structure means that near-dated contracts tend to be more expensive than older ones. Compare this to the 73cs per week before.

As nations heal from the pandemic, oil demand worldwide is rising. India’s diesel consumption is gathering pace with the onset of annual festivals, boosting sales to about pre-virus levels in the first half of October. On Nov. 8, the United States will allow foreigners to get vaccinated, providing an important boost for the sector of aviation.

©2021 Bloomberg L.P.

Fusion MediaFusion Media and anyone associated with it will not assume any responsibility for losses or damages arising from the use of this information. This includes data including charts and buy/sell signal signals. Trading the financial markets is one of most risky investment options. Please make sure you are fully aware about the costs and risks involved.

[ad_2]