SoftBank shares tumble as Alibaba, Didi and Arm experience setbacks

[ad_1]

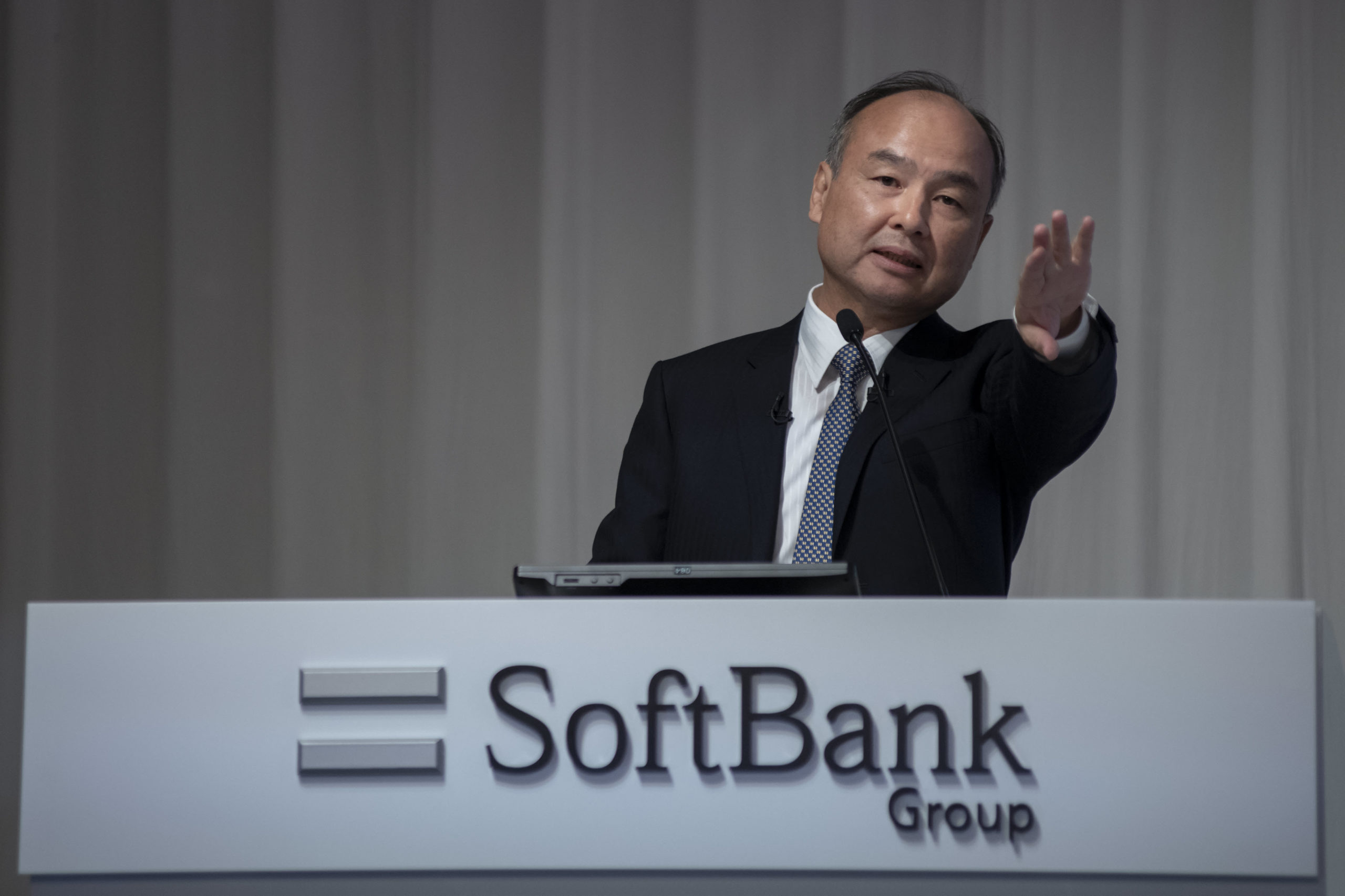

SoftBank Group chairman, CEO and founder Masayoshi son announces the earnings results of his company on May 9, 2019, Tokyo.

Alessandro Di Ciommo | NurPhoto | Getty Images

SoftBank GroupAs the portfolio company’s value continues to decline, shares plunged by over 8% on Monday

Japanese tech company, Fujitsu’s shares fell by 5201 yen ($46), to 5103 on Tokyo’s stock exchange. The shares dropped to just 5,062 yen one day, which is their lowest level since June 2020.

SoftBank shares fell for the seventh day in a row, marking uncertainty surrounding some of its biggest investments and an overall regional sale-off in tech stocks.

Chinese e-commerce firm Alibaba — SoftBank’s most valuable company — saw its market cap fall by several billion dollars Monday after the company announced a restructure.

Alibaba’s Hong Kong-traded shares plummeted over 8% after it revealed plans to form two new units to house its main e-commerce businesses — international digital commerce and China digital commerce — in a bid to become more agile and accelerate growth. It also said deputy chief financial officer Toby Xu will become the new chief financial officer from April.

The changes come as Alibaba faces headwinds on multiple fronts, including increased competition, a slowing economy and a regulatory crackdown.

SoftBank-backed ride-hailing service is available. Didi ChuxingIt was revealed last week it plans to de-list from the New York Stock ExchangeIt was IPOed less than six years ago. Chinese firms have indicated that they plan to relist on Hong Kong Stock Exchange.

Didi shares have plummeted 57% in the six months since their IPO, which was June 30th. They closed Friday at $7.80.

SoftBank has also lost Arm, a Cambridge-based, U.K.-based, chip designer, to an unrelated sale. NvidiaThis deal is increasingly unlikely. The deal is now under increased scrutiny from regulators around the world, experts say. Now is the time to make this deal “highly unlikely” to go through.

SoftBank originally offered to buy the company at $40 billion. But, the price of the deal has soaredBloomberg reports that Nvidia shares rose to $74 billion. If the deal fails, Nvidia could miss out on an important payday.

SoftBank’s millionaire founder Masayoshi Sun announced last month an $8.8 Billion share buyback in the coming year, after its Vision Fund posted a record quarter-end loss.

[ad_2]