Explainer-Sri Lanka’s reluctance to tap IMF helped push it into an economic abyss -Breaking

[ad_1]

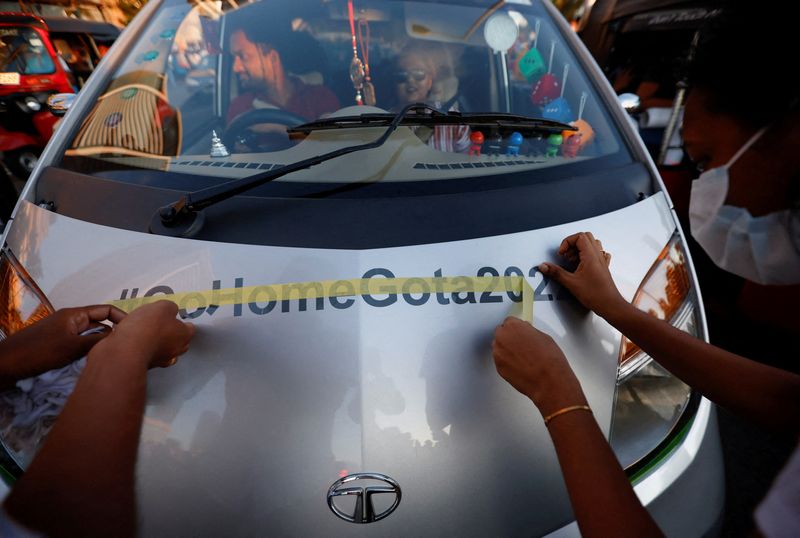

© Reuters. FILE PHOTO – Demonstrators place a sticker onto a car passing during protests against President Gotabaya Rajapaksa of Sri Lanka. This was happening in Colombo (Sri Lanka), April 16-2022. REUTERS/Navesh Chitr

© Reuters. FILE PHOTO – Demonstrators place a sticker onto a car passing during protests against President Gotabaya Rajapaksa of Sri Lanka. This was happening in Colombo (Sri Lanka), April 16-2022. REUTERS/Navesh ChitrDevjyot Goshal, Uditha Jayasinghe

COLOMBO, (Reuters) – Sri Lanka is facing its worst economic crisis. The 22-million strong nation has been experiencing prolonged power outages and a lack of fuel.

President Gotabaya Rajapaksa’s government is under more pressure because of its economic mismanagement. The country suspended payments to foreign creditors in order to maintain its tiny foreign currency reserves.

Sri Lanka is set to begin negotiations with the International Monetary Fund on Monday for a loan program. It also seeks assistance from China and India.

HOW CAME IT TO BE THIS?

Sri Lanka suffered from economic failures by its successive governments, resulting in a decline in its public finances and an excess expenditure over its income. The country also produced very little tradable goods.

This was made worse by tax cuts that the Rajapaksa government imposed shortly after its 2019 election. These were just months prior to the COVID-19 crises.

Parts of the country’s economy were destroyed by the pandemic, mainly its lucrative tourism sector. However, a rigid foreign exchange rate hampered remittances to its foreign workers.

Concerned about Sri Lanka’s finances and inability to pay large amounts of foreign debts, rating agencies downgraded Sri Lanka’s credit rating from 2020, ultimately locking it out of the international financial market.

To keep the economy alive, however, it relied heavily upon its foreign currency reserves. They were eroded by 70% within two years.

In March Sri Lanka had $1.93 billion in reserves. This was not enough to cover one month’s imports. It also led to spiralling food shortages and diesel dearths.

J.P. Morgan analysts project that gross national debt servicing could reach $7 billion in this year. Current account deficits would come in at around $3 billion.

For a related graphic on Sri Lanka’s shrinking forex reserves, click https://tmsnrt.rs/3tho32L

What DID THE GOV DO?

In the face of a rapidly changing economic climate, Rajapaksa chose to delay, rather than moving fast and seeking assistance from IMF or other sources.

Experts and opposition leaders pleaded with the government for months to take action, but they refused. They hoped that tourism would rebound and that remittances would recover.

In an interview with Reuters earlier this month, Ali Sabry, the newly appointed Finance Minister said that officials in the government and the central bank of Sri Lanka did not fully understand the severity of the situation and were unwilling to allow the IMF in. Sabry was joined by a new governor of the central bank to address the problem.

However, in light of the current crisis, India and China were contacted for assistance. The then finance minister went to New Delhi last December to negotiate $1.9 billion worth of credit lines and Swaps with India.

The President Rajapaksa then asked China for restructuring repayments of $3.5 Billion in Beijing-debt. In late 2021, Sri Lanka was also offered a $1.5B yuan swap.

For a related graphic on Sri Lanka’s foreign debt, click https://tmsnrt.rs/33M3AIQ

WHAT WILL HAPPEN NEXT

The Finance Minister Sabry is set to meet with IMF officials for talks on a three-year loan package totaling up to $3Billion.

A programme of the IMF, which usually requires fiscal discipline by borrowers, will also help Sri Lanka get $1 billion in assistance from multilateral organizations such as the World Bank or the Asian Development Bank.

The country will require $3 billion of bridge financing in the next six month to restore supply of vital items such as fuel and medicines.

Sources tell Reuters that India would be open to sending Sri Lanka another $2 billion in order to decrease its dependence on China.

Sri Lanka also requested a $500 million additional credit line from India to fuel its economy.

The government has been in talks with China to obtain a credit line of $1.5 billion and a loan syndicated up to $1 Billion. Beijing granted a loan of $1.3 billion to Sri Lanka as part of its pandemic response.

[ad_2]